FINANCIAL INCLUSION

| Indian Railways Now Seeks Suggestions from Public for Increasing its Revenue and Related Subjects : Ministry of Railway - January 20, 2015.Click here |

Financial Inclusion

From Arthapedia

Defining financial inclusion is considered crucial from the viewpoint of developing a conceptual framework and identifying the underlying factors that lead to low level of access to the financial system. Review of literature suggests that there is no universally accepted definition of financial inclusion.

Sometimes, it is easier to define a phenomenon, by stating what it is not, i.e., define financial exclusion (rather than inclusion). Financial inclusion is generally defined in terms of exclusion from the financial system. A target group is considered as financially excluded if they do not have access to mainstream formal financial services such as banking accounts, credit cards, insurance, payment services, etc.

Government of India had constituted a committee in 2006 under the chairmanship of Dr. C. Rangarajan to study the pattern of exclusion from access to financial services across region, gender and occupational structure and to identify the barriers confronted by vulnerable groups in accessing credit and financial services and recommend the steps needed for financial inclusion. The committee submitted its report in January 2008. The committee has given a working definition of financial inclusion as;

“Financial inclusion may be defined as the process of ensuring access to financial services and timely and adequate credit where needed by vulnerable groups such as weaker sections and low income groups at an affordable cost.”

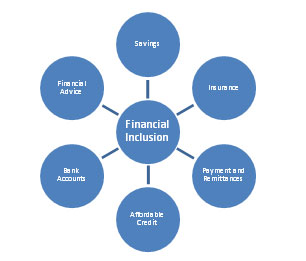

The various financial services identified by the Rangarajan Committee include credit, savings, insurance and payments and remittance facilities. The full report of the Committee may be seen here.

The Committee on Financial Sector Reforms headed by Dr. Raghuram Rajan in its Report - A Hundred Small Steps, proposed a paradigm shift in the way Government see inclusion. Instead of seeing the issue primarily as expanding credit, which puts the cart before the horse, the Committee urged a refocus to seeing it as expanding access to financial services, such as payments services, savings products, insurance products, and inflation-protected pensions. According to the committee, financial Inclusion, broadly defined, refers to universal access to a wide range of financial services at a reasonable cost. These include not only banking products but also other financial services such as insurance and equity products.

Each country has its unique way of interpreting financial inclusion depending upon the stage of development. For instance, UK had a task force based programme for financial inclusion which extended uptill 2011, that vastly differed from the traditional credit based approach of financial inclusion used in India. Similarly financial literacy which is also linked to financial inclusion stands defined by US authorities to suit their own requirement. In some countries the concept of financial inclusion also includes qualified financial advice. For United Nations Capital Development Fund (UNCDF), Financial Inclusion is achieved when all individuals and businesses have access to and can effectively use a broad range of financial services that are provided responsibly, and at reasonable cost, by sustainable institutions in a well-regulated environment.

Various facets of Financial Inclusion

The essence of financial inclusion is in trying to ensure that a range of appropriate financial services is available to every individual and enabling them to understand and access those services.

In order to achieve a comprehensive financial inclusion, a slew of initiatives have been taken by Government of India, RBI and NABARD. Some of the important initiatives include; SHG-Bank Linkage programme, opening of No Frills Accounts, mobile banking, Kisan Credit Cards (KCC) Pradhan Mantri Jan Dhan Yojna etc.

Benefits of Financial Inclusion

Financial inclusion enables good financial decision making through financial literacy and qualified advice as also access to financial services for all, particularly the vulnerable groups such as weaker sections, minorities, migrants, elderly, micro entrepreneurs and low income groups at an affordable cost so as to enable them to

a) manage their finances on day to day basis confidently, effectively and securely;

b) Plan for the future to protect themselves against short term variations in income and expenditure and for wealth creation and gaining from financial sector developments; and

c) deal with financial distress effectively thereby reducing their vulnerability to the unexpected.

The United Nations Capital Development Fund (UNCDF) investing in LDCs sees financial inclusion, financial services for poor and low-income people and micro and small enterprises as an important and integral component of the financial sector, each with its own comparative advantages, and each presenting the market with a business opportunity.

Despite the marked progress made in the direction of financial inclusion, the problem of exclusion still persist. For achieving the current policy stance of “inclusive growth” the focus on financial inclusion is not only essential but a pre-requisite. And for achieving comprehensive financial inclusion, the first step is to achieve credit inclusion for the disadvantaged and vulnerable sections of our society.

Comments

Post a Comment